What is W2 and Corp to Corp? Difference between W2 vs C2C

People who are currently working or retired will agree with the statement that receiving their first salary is one of the most memorable moments of their life. Earning money gives you wings of freedom and a sense of responsibility. This is especially true if you are an international student in the United States. Students coming from other countries are also allowed to work part-time in this country, and this helps them to sustain themselves by paying for their boarding and lodging. This, in turn, reduces the financial burden on their family, who have most probably spent a good amount on their college or university fees.

Students in the USA put in their best effort to find a full-time or part-time job. But you must gain the necessary knowledge before accepting any employment opportunity, especially if you are an international student pursuing education in the USA. You need to compare various modes of working to make the right decision. In simple words, you should understand what “W2 vs C2C” is.

If you have encountered them before, you might be unsure what exactly they are. You won’t need to worry because this article will inform you about W2 and C2C employment. Look through the information to learn how puberty affects your health. We need to make sure we first understand W2 and c2c employment and which individuals each includes. Once you’ve figured this out, you can start looking for and applying for jobs within your category.

What are c2c and w2?

W2 and C2C are working options available for prospective employees who come into contact with any organization or employer through staffing or recruitment agencies. These prospective employees are called ‘candidates’ or ‘consultants’. Here comes an important question – “On what principles is this classification built, i.e., what is W2 C2C? If you work as a staffing agency, your earnings determine whether you get a W2 or a C2C.. We will look at these factors in detail in this blog post, so that if you are a student in the United States or planning to become one, then you can make sure that you are on the right side of the employment laws of this country.

What is a W2?

W2, which stands for the wage and tax statement, is a tax form given by employers to employees in the month of January every year. This document contains the details related to income earned and taxes payable by an employee. Now, to be classified under this category, you must satisfy certain conditions.

Besides tax details, the W2 also contains crucial information related to the contribution of the employer to the retirement fund, benefits of those who are dependent, and health savings, which may or may not be included. The W2 is crucial for abiding by the tax laws of the country, which is why employers are required to share W2 copies with employees and the IRS by the 31st of January. Failing to share this document can lead to unnecessary delays, penalties, and tax audits.

Let’s see what constitutes a W2 Employee/Contractor.

Many people learning about W2 vs C2C get intrigued by the difference between a W2 employee and a W2 contractor. Well, these terms are used interchangeably as the line between ‘employee’ and ‘contractor’ becomes blurred when it comes to W2.

But, ‘W2 employee’ sounds more appropriate while discussing this working arrangement. The term ‘W2 employee’ refers to the person who is employed by the organization through a staffing or employment agency. The following example will clarify it better.

‘John’ takes the help of the ‘ABC’ recruitment agency to land a job in the ‘XYZ’ company. Now, John performs duties prescribed by the organization, i.e., end client of a staffing agency, which is XYZ Company in this case, within working hours and the rules of the organization. Therefore, he is treated like a full-time employee in certain aspects, such as taxation and payroll benefits.

The taxes of an employee are deducted from his salary and paid to the concerned authorities on his behalf. However, the benefits provided to him vary from company to company. While a company ‘A’ might offer him a number of benefits, like health insurance, sick leaves, paid vacation, and a retirement plan, a company ‘B’ might choose to offer only a few benefits. As a candidate, you should clarify these benefits with your employment agency before you even apply for the job. And make sure that you take up a job that gives you the benefits that you require.

An important point to consider here is that John will be on the payroll of the ABC recruitment agency as he is considered their employee. He will be called “W2 of the ABC recruitment agency”. For the ‘XYZ’ company, John is a contractor with whom a contract will be signed. So, even if John switches from ‘XYZ’ to ‘PQR’ company on the recommendation of ‘ABC’ recruitment agency, he will still officially remain as an employee of ‘ABC’ agency.

Another advantage of being a W2 employee is that John can work for multiple companies or employers. Moreover, he does not need to calculate taxes or keep records of accounting transactions. He will receive a W2 tax form with details of his salary, tax withholdings, and so on from the staffing agency. He can use this tax form for filing his taxes. Generally, the contract for this type of employment is for a fixed period of time.

Hence, the employer cannot terminate you before the end date of the contract, except in cases of gross misconduct. The recruitment or placement agency gets paid by its end client for its services, which include finding new candidates, scheduling interviews, etc.

We hope ‘W2 vs C2C’ does not seem as difficult to you as it was at the beginning of this blog post. Moving further, let’s delve into C2C.

What is C2C?

C2C, which stands for Corp-to-Corp or Corporation-to-Corporation, is an agreement that takes place between two business entities. Individuals searching for a suitable opportunity to work and earn can choose this route. You should have the status of an ‘S-corp’ or an ‘LLC’ to enter into a C2C agreement. “But is it that simple?”

The main advantage of a C2C agreement is to close a higher income with the employer. The C2C ensures that the contractors start their negotiation rates, business expenses, and taxable income, which enables a higher income. But this applies only to a business that is being maintained with a proper license and all taxes are paid on time in compliance with the latest labor laws.

Generally, C2C contracts necessitate a strong contract with all the parties’ provisions concerning the scope of work, terms of payment, and liabilities. Additionally, the business has to comply with state and federal laws regarding any form of misclassification, thus leading to penalties. Even so, C2C offers freedom and entrepreneurial chances but demands knowledge about the practice of doing business, taxation, and money management in order to succeed.

To understand C2C more clearly, read the paragraphs below.

To set up an ‘S-corp’ or an ‘LLC’, you need to complete various time-consuming and expensive processes. Next, you need to find an organization that not only requires the skills and talent possessed by you but also agrees to pay the fees expected by you. Being the sole authority of your business, you can exercise greater control over operations and working conditions.

C2C working arrangement is preferred by companies that recruit people for short-term contracts. So, you can switch companies or employers for learning new skills and acquire experience. But at any given time, you cannot work for more than one employer. Companies that wish to avoid the burden associated with hiring and retaining employees go for C2C.

You should buy a liability insurance plan to cover claims made against your business for compensation of damages or injuries. Taxes will not be deducted from the salary or fees paid to you. But wait, before you jump with excitement, as no deduction of taxes does not mean that taxes will not be levied on your income. You will be responsible for calculating and filing your taxes on a quarterly basis.

You can ask an accountant to assist you, but it would lead to an additional expense. The tax rate imposed on consultants in this arrangement is higher than that imposed on W2 employees or 1099 independent contractors. However, as they say, ‘every cloud has a silver lining’, you can charge higher remuneration from the company for fulfilling your tax obligations as well as reimbursing the expenses incurred by you.

You need to submit an invoice to the company to receive payment for the work completed by you. The payment is released after 30-60 days. At times, it can take even more than 60 days. As you cannot be considered an employee of the organization for which you are working, you will not be able to enjoy healthcare, retirement, and other benefits. But it gives you a chance to design your own benefits package and retirement plan.

After reading what we discussed above, C2C vs W2 could seem more challenging if you are a student visa holder in the USA. Read further to understand where you belong.

You can become a part of this arrangement by signing an agreement with a placement agency. Your resume will be shared with the clients of the placement agency. On getting selected by one of the companies, you can start working. But, officially, you will be on the payroll of the staffing agency. You will be considered and treated as an employee of the recruitment agency.

Another scenario that is categorized as ‘C2C’ is where two recruitment firms join hands to meet the needs of a company. Let’s suppose ‘ABC’ placement agency has ‘XYZ’ company as a client. Now, ‘XYZ’ company needs a person to carry out certain activities. But ‘ABC’ recruiters can’t find a suitable match in their database. So, they approach the ‘PQR’ staffing agency that has a candidate who can best fit the position.

The candidate, on clearing the interview, will begin to work for the ‘XYZ’ company. Unlike W2 employees, C2C consultants don’t have job security or chances of getting a contract IT job converted to full-time employment. If you have joined an organization through a recruiter, the spoiling of relations between the two can also affect your contract. So, you might find yourself unemployed for no fault of your.

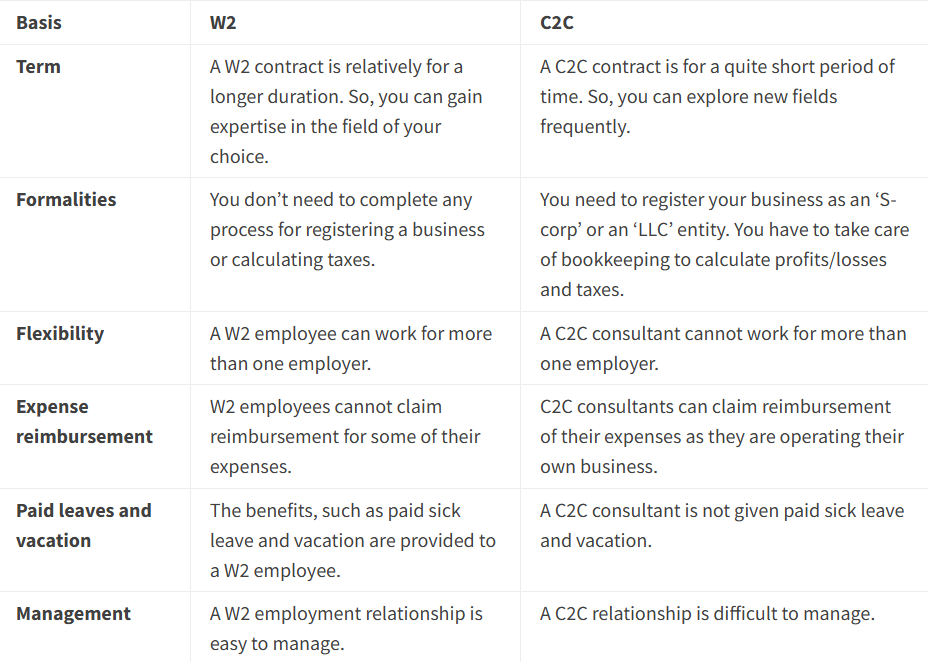

W2 vs C2C – Differences You Must Know

We believe you now understand the difference between W2 and C2C employment. Though there are hints to the difference between W2 and C2C, we wanted to make them clear for you.

W2 Contract vs Corp to Corp – Which is Better for You?

Both c2c and w2 methods come with positives and negatives, and what is best depends on the situation. A disadvantage related to being a W2 employee might actually help one candidate stand out. For that reason, you have to carefully think about several points before deciding which is better for you.

We have provided some tips for making your task easy. Let’s have a look at them:

- If you accept a W2 employment offer, you will be entitled to various benefits. You should read the contract properly to know the benefits.

- If you choose to set up an ‘S-corp’ or an ‘LLC’, you must learn how to register your business and file taxes as per the rules applicable in your state.

- In case of legal claims, a C2C consultant can get a little relief, as their personal assets will be considered as separate from his business assets.

No matter which job option you prefer, you will have an interview with the company that matches you before you start working. This part is important for you to secure your job.

Custom Lapel Pins can be a plus during your interview process. The charm of customized badges is that each badge is tailored and unique according to your personality and needs. Before the interview, you can customize lapel pins that are suitable for the interview and unique to you according to your personal preferences and job requirements.

Wearing a lapel pin to an interview not only reflects your unique understanding and attention to the position but also highlights your personality, charm, and professional attitude. Such details often allow the interviewer to feel your dedication and preparation, thus leaving a deeper and more positive impression among many candidates.

Conclusion

Congrats! You made it to the conclusion. We admire your interest level and patience for C2C w2 employment. You need to show the same qualities while hunting for your job. In the end, we would just like to say that whenever you visit any staffing agency or organization, engage in an open dialogue to make sure you make the right decision. Don’t let any of your confusion regarding W2 vs C2C come in the way of your career.